It was 2001, when Jim O’Neill, chief economist at Goldman Sachs coined the term BRIC to represent the emerging economies of Brazil, Russia, India and China as a block. In the past decade, BRICS (“S” for South Africa included later) has become a near ubiquitous financial term, shaping how a generation of investors, financiers and policymakers view the emerging markets.

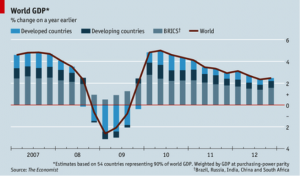

O’Neill predicted – that by 2041 (later revised to 2039, then 2032) the BRICS would overtake the six largest western economies in terms of economic might. He boldly predicted that these five nations would come to represent the pillars of the 21st-century economy. At the time, many scoffed at this idea. But, critics of BRICS have already been proven wrong as shown by the chart below.

Financially, the 2008 crisis has left old-power western governments and their banks mired in debt and toxic assets. In 2009, when advanced economies’ gross domestic product (GDP) fell 3.43 percent, emerging market economies grew 3.1 percent. Capital poured in – from investors looking for the only place they could actually grow their money. While recently growth has slowed in the BRICS economies, and prospects brightened in some old powers, many doubt the depth or permanence of this shift.

Since the U.S. Federal Reserve started to taper its $85 billion monthly stimulus policy that had been sending cash towards emerging markets, the BRICS as well as others experienced massive currency drops and capital outflows. BRICS nations finally turned to each other for assistance, instead of their developed country counterparts, and decided to cushion themselves from volatile global markets. This was the genesis for “BRICS Bank”.

Static voting rights at the World Bank and IMF, shortfalls in financing for infrastructure, and the national priorities of the BRICS countries, finally gave way to the new BRICS Bank. The bank will start lending by 2016 with an initial capitalization of US$50 billion and a US$100 billion emergency reserve fund.

BRICS bank may eventually challenge the World Bank-IMF hegemony over matters such as: funding for basic services, emergency assistance, policy lending, and funding to conflict-affected states. It could be the building block of alternative world order.

How well is your portfolio positioned to take advantage of the global power shift? Contact Dino Zavagno MD at Gladstone Morgan or a member of his team for professional advice.

Disclaimer: All content provided on this page are for informational purposes only. Gladstone Morgan Limited makes no representations as to the accuracy or completeness of any information on this page or found by following any link on this page. Gladstone Morgan Limited will not be liable for any errors or omissions in this information nor for the availability of this information. Gladstone Morgan Limited will not be liable for any losses, injuries, or damages from the display or use of this information. This policy is subject to change at any time.

It should be noted the services available from Gladstone Morgan Limited will vary from country to country. Nothing in the comments above should be taken as offering investment advice or making an offer of any kind with regard to financial products or services. It is therefore important to reinforce that all comments above are designed to be general in nature and should not be relied upon for considering investment decisions without talking to licensed advisers in the country you reside or where your assets may located.Gladstone Morgan Ltd is not SFC authorized. Gladstone Morgan Ltd in Hong Kong is licensed with the Hong Kong Confederation of Insurance Brokers.